Labor, equity and domestic content rules in the 2022 Inflation Reduction Act must not make it too complicated for electric vehicle buyers or force cumbersome sourcing changes on carmakers, stakeholders said.

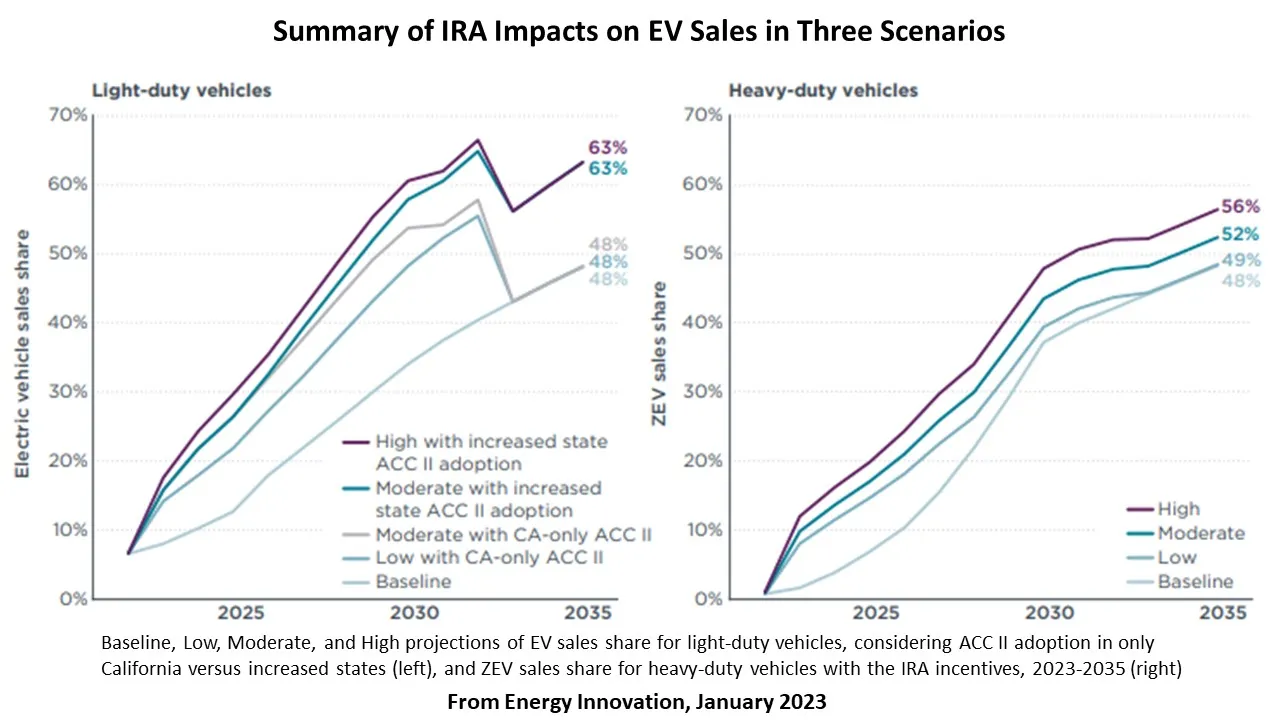

With the IRAâs expanded tax credit and funding, it can move EVs âinto the fast laneâ by accelerating emergence of a U.S. supply chain and charging infrastructure network, a January Energy Innovation report found.

The IRA, along with the Infrastructure Investment and Jobs Act, provides ânearly 30 timesâ the total EV funding in all previous federal programs, Atlas Public Policy found in September 2022.

But current rules include complexities on tax credit eligibility that could âdiscourage consumers and EV industry investments,â said Atlas Public Policy Founder Nick Nigro. And âeligibility will be more complicated when it includes requirements for battery component and critical battery material sourcing,â he added.

Clarity is needed, according to the more than 880 stakeholder filings with the Treasury Departmentâs Internal Revenue Service requesting guidance on how to implement aspects of the IRA, including comments from Ford, Dow and Samsung, .

IRS guidance on the IRA can create âa new future for U.S. transportationâ if it âbalances the needs of drivers, the EV industries, and the intent of the law,â said Electrification Coalition Vice President of Policy Katherine Stainken. âIt is likely to be complicated but months of delay will mean little against decades of transformation,â she said.

Treasury must meet the lawâs intent to renew the U.S. auto industry, policy analysts said. That will require rules for carmakers to identify and validate the complexities of battery component and critical mineral sourcing in ways that are simple for car buyers to understand, which is a challenging conundrum, stakeholders agreed.

The good news

The IRAâs key feature in support of EVs is $12.5 billion to extend and expand the up to $7,500 federal tax credit for EV buyers, Environmental and Energy Study Institute data showed. But its domestic sourcing and labor requirements will be much more complicated than todayâs domestic vehicle assembly obligations, stakeholders agreed.Â

The new vehicle tax credit is limited to buyers with annual incomes of up to $300,000 for those filing joint tax returns, $225,000 for head of household filers, and $150,000 for individuals, according to the IRS. It is also limited to new cars costing $55,000 or less and new trucks, vans, or SUVs costing $80,000 or less, the IRS added.

A tax credit for used EVs covers up to 30% of the cost, with a maximum credit of $4,000 for qualified vehicles at least 2 years old and costing up to $25,000, again with tiered buyer income limits, according to the IRS.

The IRA retains the $1,000 residential EV charger tax credit and provides $10.4 billion to increase the 30% of cost commercial charger tax credit from a $30,000 to a $100,000 maximum investment per charging station, according to the Department of Energy. But new requirements limit the new creditâs use to chargers in non-urban areas or areas with low-income populations, DOE added.

IRA grants and loans will also fund state and local transportation electrification work and domestic battery and critical minerals manufacturing and recycling, according to the White House IRA guidebook. And access to these grants and loans is being expanded to a âdirect payâ option that allows those with limited tax burdens or tax-exempt entities upfront cash payments instead of tax deductions, the guidebook said.

IRA tax credits can reduce light duty EV costs as much as $9,050 per vehicle and increase sales as much as 67% by 2032, depending on Treasury guidance, Energy Innovation reported. They will also enable âmore stringent federal vehicle standards at a lower cost and higher benefit to consumers,â EI added.

The IRA and Treasuryâs preliminary plans

The IRA requires battery components and critical minerals to be sourced domestically or from Free Trade Agreement partners, and not from âforeign entities of concern,â the White House IRA guidebook said.

But only Treasury guidance, expected by the end of March, will definitively clarify how that sourcing is to be measured and applied to tax credit uses, Electric Drive Transportation Association, or EDTA, President Genevieve Cullen and others said.

A December 2022 Treasury white paper offered preliminary interpretations of IRA critical mineral and battery component requirements which âseem like a logical approach,â the Electrification Coalitionâs Stainken said. Many stakeholders largely agreed.

Treasuryâs plan would allow new vehicle tax credits of up to $3,750 for meeting the battery components requirement and up to $3,750 for meeting the critical minerals requirement, said EDTAâs Cullen.

For 2023, 50% of the total value of battery components must be domestically sourced, and that increases to 60% for 2024 and 2025, and has 10% annual increases on the way to 100% after 2028, Treasury proposed.

For critical minerals, vehicles placed in service in 2023 must have 40% domestic content extracted or processed in the U.S. or Free Trade Agreement countries, or be recycled in North America, Treasury suggested. That would increase 10% annually to 70% in 2026 and then to 80% after 2026, it added.

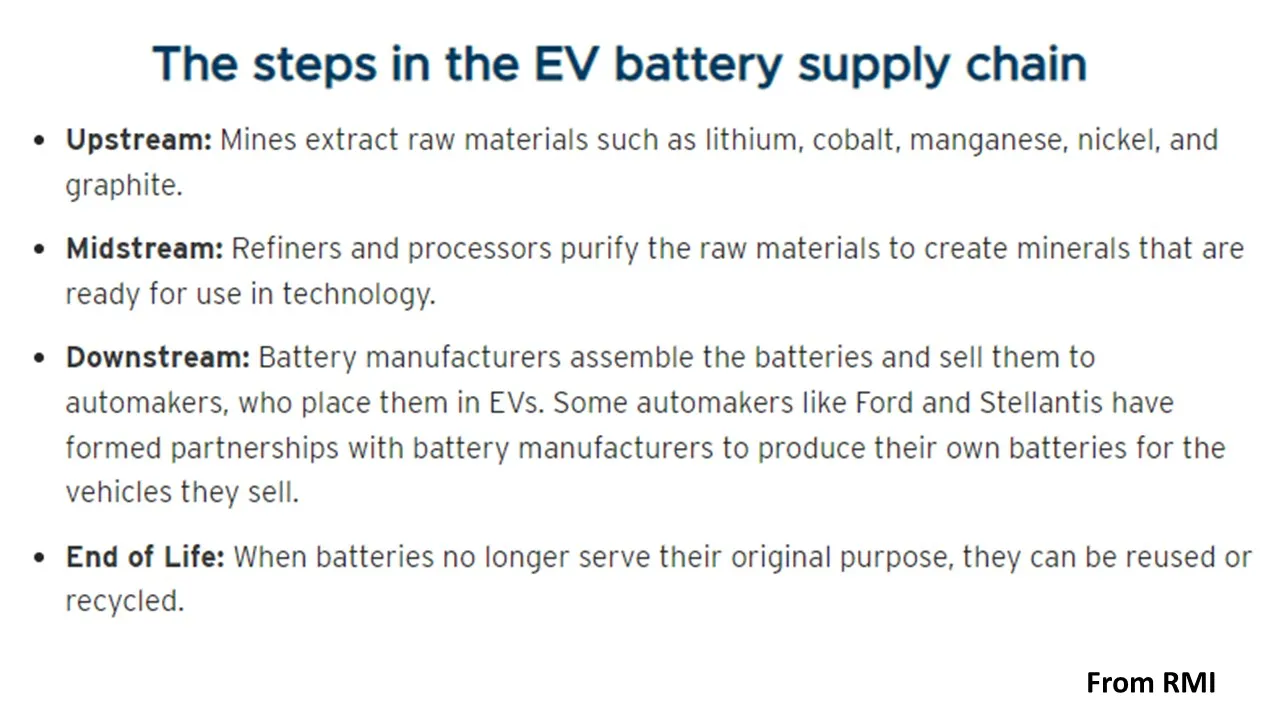

Defining âthe extraction, processing, and recyclingâ of critical minerals and âwhere those activities occurâ in multi-step supply chains will be vital to certifying compliance, the Treasury white paper said. A three-step âtransition ruleâ through 2024 can address the complexity and provide manufacturers âtime to develop the necessary capabilityâ throughout their supply chains, it added.

First, battery makers would identify critical mineral procurement chains, Treasury proposed. They then would determine whether the critical mineralsâ extraction, processing or recycling qualified as domestic, and finally manufacturers would calculate how much of each batteryâs total value those critical minerals represented, it said.

But other complexities are left unresolved by Treasury, stakeholders said. âConstituent materialsâ can âcontain critical mineralsâ used to make âbattery components,â Treasury acknowledged, leaving determinations for the proposed total battery component valuations uncertain.

Implementation of the new rules is likely to be complicated, âbut that is critical to meeting the intent of the law to transform transportation,â the Electrification Coalitionâs Stainken said. Treasury âseems to be working methodically on clarifications,â and âwhatever the next proposed guidance is, a final formal rulemaking will follow in six months or so that could further shape compliance,â she cautioned.

Meanwhile, Treasury is wading through the more than 880 filings from stakeholders on questions about how to use the new tax credits, many with opposing opinions on key questions.

Three key questions

The U.S. EV ecosystem awaits answers on how to make IRA tax credit eligibility simple for car buyers, what the maximum tax credit available is for EV charging infrastructure, and how to conform the IRA with global supply complexities.

Will buyers understand?

A vehicleâs tax credit eligibility can presently be confirmed by entering the Vehicle Identification Number into the interactive âDOE decoder,â Plug-In America reported. But significant questions remain about how domestic content, buyer income, and carmaker prices will be verified under IRA rules, Plug-in America acknowledged.

âThe simpler for consumers, the better,â because lack of clarity âcan create market turmoilâ and because âa process hard for consumers to understand and use could lead them away from EV purchases,â Atlasâs Nigro said.

A recent survey confirmed that concern. Of car buyers interested in EVs, 93% reported the credit is either âsomewhatâ or âvery importantâ to their purchase, according to November GfK AutoMobility research. And 70% of those who see the tax credit as âvery importantâ would change their plans if their first-choice vehicle was not eligible and 15% would not buy an EV, GfK found.

A process that is too difficult âcould be the difference between accessibility to thousands of dollars of tax credits for a car buyer and billions of dollars in EV industry investments,â Nigro warned.

What is a charging station?

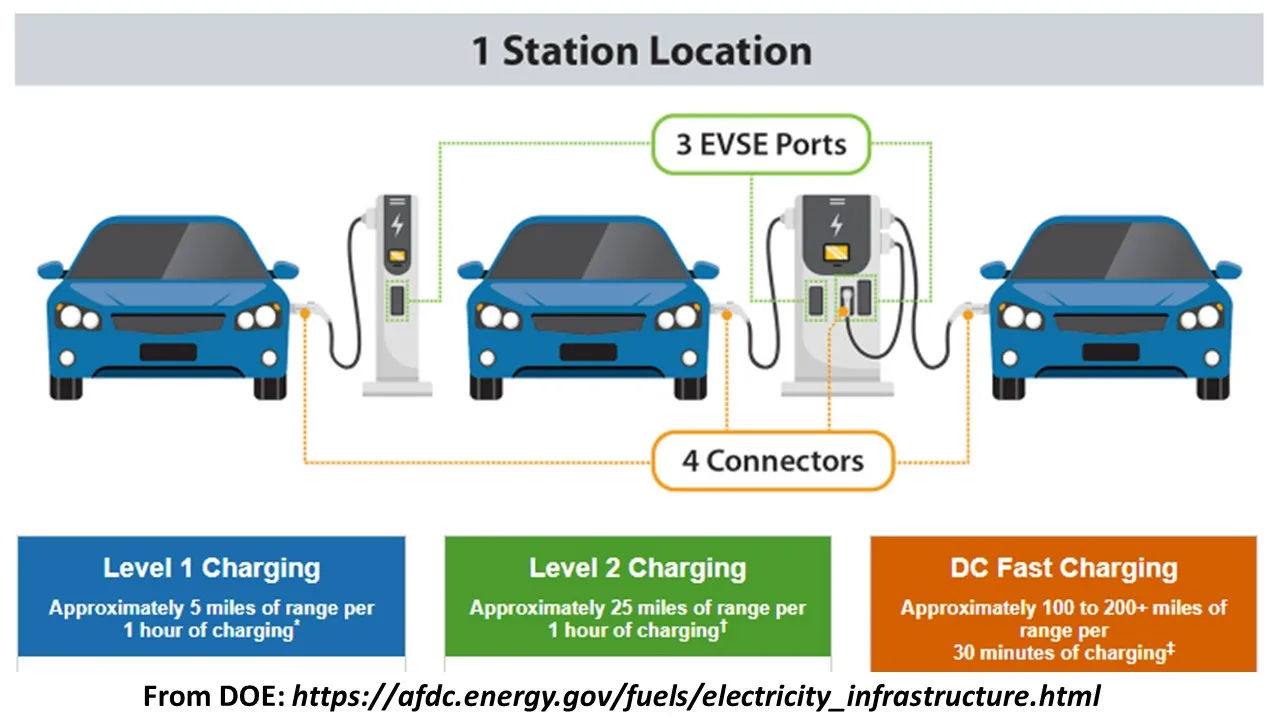

To meet the federal goal of 50% of annual new vehicle sales by 2030 being zero emissions, the U.S. may need almost 20 times more charger installations than it now has, according to an April 2022 McKinsey & Company analysis.

Utilities like Consolidated Edison and Arizona Public Service are awaiting Treasury guidance before finalizing charge deployment, they said.

Treasury may confirm that investor-owned utilities can âuse the credit for electrical equipment or electric service upgradesâ and to âinstall and ownâ EV chargers and related infrastructure, said Edison Electric Institute Senior Director of Electric Transportation Kellen Schefter.

That buildout is supported by IRA-allowed tax credits for each installed âsingle itemâ for charging, according to the bill. And the tax credit increase to $100,000 âwill support the more expensive faster chargingâ needed at high demand stations like commerical fleet parking sites in lower income areas and corridors in rural areas connecting communities, said EV Connect Director of Energy and Utilities James Ellis.

But charging station credit eligibility depends on yet-to-be fully finalized wage and apprenticeship requirements and yet-to-be fully defined low-income locations, he said. And the meaning of the âsingle itemâ term must be clarified, he stressed.

A single item might be a charging station or a charging port, and a station with two ports for charging two vehicles might have a $100,000 or a $200,000 maximum and a $30,000 or $60,000 tax credit, Ellis said. âThat can be critical as the need for bigger and more charging capacities growsâ and more stations are built on a âconvenience store-gasoline stationâ model with multiple chargers and ports, he added.

A âsingle itemâ might also be a utility system upgrade, equipment to meet new charger loads, or site improvements, Ellis and other stakeholders said. The âsingle itemâ questions, also raised in EDTA and Natural Resources Defense Council filings, are important to avoid deployment of outdated technology, and enable installation of solar-powered and bidirectional chargers, EDTA said.

This guidance will be needed by private charger builders and utilities as well as by tax exempt entities like rural electric cooperatives, publicly owned utilities and non-profit organizations that can now use the âdirect pay optionâ to build and own charging infrastructure, Ellis added.

What is domestic?

The U.S. âis at an inflection point,â Christopher A. Smith, Fordâs chief government affairs officer, wrote in an IRS filing. Guidance can keep it âan economic and technological leader on the world stageâ and ensure âthe EV revolution is Built for America,â he added.

Most stakeholders agreed. The IRA can help âshift overall U.S. policy toward building an EV industry that does not repeat the wrongs of the fossil fuel-powered vehicle industry or the human and environmental abuses of some battery supply chain providers,â Atlasâs Nigro said.

But that may be difficult until carmakers ârealign their supply chains and record keepingâ with new domestic content complexities, RMIâs Treasury filing acknowledged. Two key challenges are that âonly a small percentage of critical mineralsâ are sourced from the U.S. or Free Trade Agreement countries and âmost battery manufacturingâ is outside of North America, a filing from Resources for the Future added.

âThe global supply chain for vehicles, components, batteries, and the minerals of which those batteries are made is an extremely complex web that no one can accurately depict at this time,â NRDC wrote.

But inclusive definitions of extraction, processing, manufacturing, recycling, and value, and better supply chain tracing and tracking can âimprove supply chain transparency,â RMI said. That can also improve âchain-of-custody reporting with end-to-end traceability and cooperation from the full value chain of suppliers and recyclers,â which can enable implementation despite IRA complexities, it added.

Both International Material Data System and Global Battery Alliance Battery Passport databases offer digital platforms to track sourcing and provide âclarity to dealers and consumers,â RMI added.

But guidance is still needed, especially on the meaning of âforeign entities of concernâ, filings from BYD Auto, a U.S. subsidiary of Chinaâs BYD, and the Coalition for American Battery Independence agreed. U.S.-based subsidiaries âestablished and operated under the laws of the U.S.â should not be considered ineligible for tax credits without âevidence of control by the governmentâ of the foreign entity of concern, BYD wrote.

The IRA âwas written to build a domestic and sustainable supply chain for the EV transition,â but Treasury guidance is needed, Atlasâs Nigro said. âAnd when it comes, the companies ready to comply with it will be first movers and will get a big boost in the race to the top,â he added.